As discussed in a previous post, the Corporate Transparency Act (CTA) requires most business entities in the United States, including community associations, to report beneficial ownership information to an agency of the Treasury Department,FINCen, by January 1, 2025.

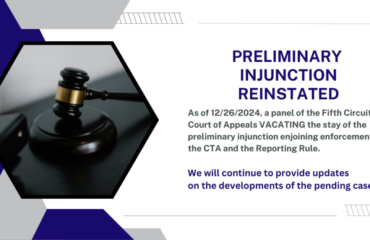

A federal judge, on December 3, 2024, issued an order granting a preliminary injunction blocking the enforcement of the Corporate Transparency Act (“CTA”). The injunction order, granted by a federal judge in Texas in a case initiated by multiple small businesses, states that it applies nationwide and that no business entity needs to comply with the CTA deadline. The Court has held that the CTA is unconstitutional as it exceeds the authority of the federal government.

On December 5, 2024, the federal government did file an appeal to this decision to U.S. Court of Appeals for the Fifth Circuit. Even though it is difficult to predict the timing and ruling of any appeal, it seems as if the January 1, 2025 deadline for BOI reporting will be extended. FinCEN has issued an alert on its website offering the following guidance:

“In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.”

It is important to note that there have been cases in other courts, raising the question of the constitutionality of the CTA, and those courts have reached other conclusions. Therefore, there is no guarantee that this injunction will be upheld. It is important for business owners, those deemed beneficial owners under the CTA, and community association boards to stay up to date on the developments of the case and to be prepared to file BOI Reports.

If your business or association has any questions regarding the CTA, the reporting requirements, or the injunction, please reach out to us here.

Related Information:

Corporate Transparency Act and Beneficial Ownership Information Reporting Requirements

Are Community Associations Reporting Companies Pursuant to the Corporate Transparency Act?